Original Public Pension (Do NOT PUBLISH)

The Public Pension page contains information required by the Texas Comptroller of Public Accounts to qualify for the Comptroller's Transparency Stars program. This information will provide a broader understanding of the City's finances.

The City of Corinth participates in a pension plan provided by the Texas Municipal Retirement System (TMRS). TMRS is an agency created by the State of Texas and administered in accordance with the TMRS Act, Subtitle G, Title 8 of Texas Government Code. Each participating government's pension is centrally administered and governed by state statutes, but the assets and related pension liabilities for each government are accounted for separately, and any unfunded liabilities are solely the obligation of that government. Benefit options are adopted by the governing body of the City, within the options available in the state statutes governing TMRS. Upon retirement, the employee's account balance including interest is combined with the employer match to price a lifetime annuity based on the employee's age at retirement.

Public Pension Summary

(TMRS Actuarial Valuation 12/13/2020, City of Corinth CAFR 9/30/21)

| Funded Ratio 2 | 89.5% |

| Amortization Period For Unfunded Pension | 22.90 Years |

| One Year Rate of Return 3 | 7.65% |

| Three Year Rate of Return 3 | 6.46% |

| Ten Year Rate of Return 3 | 6.74% |

| Assumed Rate of Return | 6.75% |

| Actuarially Determined Contribution Rate, Contributions for Calendar Year 2020 | 15.03% |

| Total Actual Contribution Rate, Contributions for Calendar Year 2020 | 15.19% |

| Unfunded Actuarial Accrued Liability (UAAL) (as a % of covered payroll) | 54.80% |

1Actuarial valuations are produced by TMRS on a calendar year basis and the City operates on a fiscal year ending 9/30. Valuations for a given year are used in the following year's City Comprehensive Annual Financial Report ("CAFR"). For example, the 2018 valuation was produced during the City's 2019 fiscal year and was used in preparing the City's 2019 CAFR. The 2018 valuation also set the contribution rate for use in calendar year 2020.

2The funded ratio for a pension is the value of pension assets divided by the value of the pension liability. TMRS reports funding data to the City on both a market basis and a funding basis. The market basis reports the fair market value of pension assets as of the reporting date (December 31 of the year of valuation for TMRS). The funding basis smooths market gains and losses for pension assets over a period not to exceed ten years. This treatment allows TMRS' actuary to set the City's contribution rates in a way that does not cause large spikes or declines in the rates year over year due to market fluctuations. The market basis is reported in the financial statements and footnotes of the City's CAFR. The funding basis is included in the statistical section of the City's CAFR.

3Rates of return presented are calculated using a time-weighted rate of return methodology based upon market values, and are presented gross of investment management fees as reported by TMRS. More detailed information regarding investment objectives can be found at https://www.tmrs.org/investments.php

Pension Fund Additions by Source and Deductions by Use Downloadable Data

View 5 years of data detailing the additions by source, such as investment income, employer and employee contributions, and deductions by use, such as benefit payments, withdrawals, and administrative expenses.

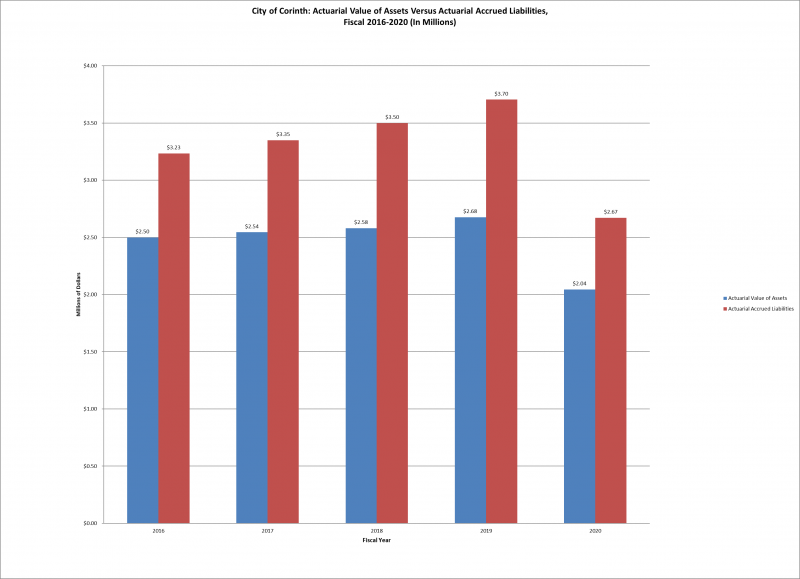

Historical Actuarial Value of Assets versus Actuarial Accrued Liability Downloadable Data

View 5 years of data detailing the actuarial value of assets versus actuarial accrued liability over time.

TMRS Rate Letters

Rate letters are issued by TMRS, and provide the contribution rate for the following calendar year, a summary of the pension plan funding and position, and information on changes that affect the plan.

Rate Letter 2022

Rate Letter 2021

Rate Letter 2020

Rate Letter 2019

Rate Letter 2018

Rate Letter 2017

Rate Letter 2016

Rate Letter 2015

Actuarial Valuations

Actuarial valuations are produced by TMRS on a calendar year basis and used to determine the amount that, when combined with investment ratings, should be consistently deposited into a retirement fund to ensure sufficient funds to pay promised benefits in full and over the long term. Because the City operates on a fiscal year ending 9/30, valuations for a given year are used in the following year's City Comprehensive Annual Financial Report (CAFR).

TMRS Valuation 2020 GASB 68 Valuation 2020

TMRS Valuation 2019 GASB 68 Valuation 2019

TMRS Valuation 2018 GASB 68 Valuation 2018

TMRS Valuation 2017 GASB 68 Valuation 2017

TMRS Valuation 2016 GASB 68 Valuation 2016

TMRS Valuation 2015 GASB 68 Valuation 2015

TMRS Valuation 2014 GASB 68 Valuation 2014*

* Due to a change in GASB reporting requirements, the 2014 GASB 68 Valuation, released in 2015, was the first year this report was produced.

TMRS Comprehensive Annual Financial Reports (CAFR)

The CAFR is TMRS’s official annual financial statements prepared in accordance with Generally Accepted Accounting Principles (GAAP). The TMRS CAFR provides comprehensive financial information including statements of fiduciary net position and changes in fiduciary net position. City specific information can be found in the appendices.

Texas Comptroller of Public Accounts Public Pension Search Tool

To search for details on state and local pension plans in Texas, visit the Texas Comptroller website.